Second part of the step by step guide how to make a business plan. This part is focused more on the execution of the business plan. You will find here strategy to enter the market, financial projections and project plan chapters.

Content of the second part of the business plan

- Developing a business plan – Execution

- Company personnel overview

- Finance and project plan

- Business Model

- Financial Statements

- Forecast and Break even point (BEP)

- Development timeline, milestones and work-packages

- Risks and opportunities

- Appendix

4. Developing a Business Plan – Execution

When it comes to put the business plan into real life, executive planning plays the prime role as a financial plan shows where the money will come from and go, the execution plan outlines what specifically needs to be done and when.

Developing a business plan is a skill to review your critical goals or milestones, as well as to track specific tasks to ensure that everything is on track, on time and budget.

Chapter 4 is dedicated to three main topics.

- Market entry strategy

- Marketing and business plan (Short form for purposes of the business plan)

- Intellectual property rights (IPR)

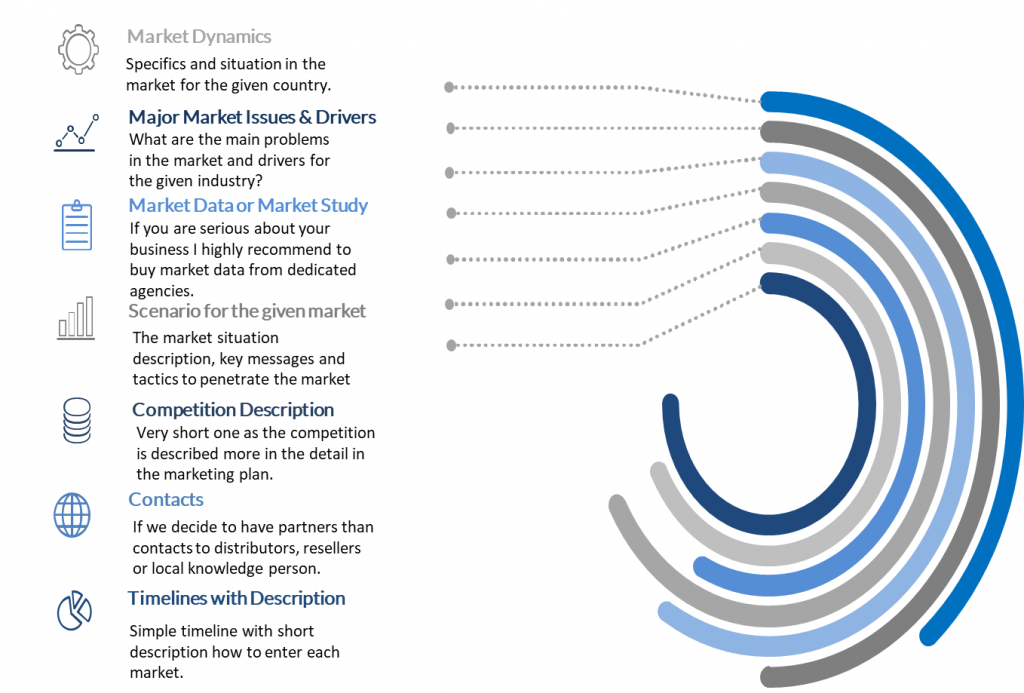

Main points for Go To Market strategy

- Market dynamics – Specifics and situation in the market for the given country.

- Major market drives & issues – W hat are the main problems in the market and drivers for the given industry?

- Market data or market study – If you are serious about creating your business plan in high detail. I strongly recommend to buy market data from dedicated agencies. I would not advice to use data of standard desktop research as these data may be defective or outdated. Investors ask often questions where the data come from.

- Scenario for the given market – The market situation description, key messsages and tactics to penetrate the market .

- Competition description – Very short one as the competition is described more in the detail in the marketing plan.

- Timeline with description – Simple timeline with short description how to enter each market.

- Contacts – Mention of distributors, resellers or partners that will help you with introduction to given market.

Other important aspects to mention when writing a business plan execution are product development, concept of sales distribution and promotion.

4.1. Market Entry Timeline and Description

Many companies, understand that highly effective marketing is the key to success. Each market is slightly different and it is important to prepare the market entry plan that is consistent with marketing strategy [later in this article].

Market entry strategy (also called Go to market strategy) is different from business to business and it encompasses same structure or points for all businesses.

4.1.1. Product development

Develop the products demanded by the market. Important features that your marketing efforts have to define are – apart from the technical specifications of the product – finishing, presentation/packaging, price, etc.

4.1.2. Selling and distribution concept

There are many selling and distribution channels available in the market choosing the right channel for your product is necessary for the market.

Below are few concept of sales distribution:

- Distributor

- Resellers and their networks

- Freelancers

- Direct entry to the market with subsidiary creation

- Licenses

- Strategic partnerships

- Merger or acquisition (but this is not applicable in our case)

4.1.3. Product promotion

Develop and execute a promotion, advertising, and public relations campaign to inform the target clients about your products or services and the benefits they can derive from them.

You can find distribution and product promotion concept in files to download on slide 11 and 13.

4.2. Marketing Plan

Once you decided to make the business plan, marketing plan is essential part of it. For purposes of our business plan, marketing plan may be simpler than the marketing plan used for strategy purposes although it contains all necessary elements that are crucial for the business (Simpler version of company marketing plan).

After Examined the market and the competition (having all necessary data about our markets) it is time to make a marketing plan.

Know your Business- Before making the plan you have to know your business correctly. In this section, you describe your business with SWOT (strength, weakness, opportunity, and threats) analysis is more than enough to know your business.

Please take into account that strengths and weaknesses are internal factors of the company. Contrary to opportunities and threats which are external factors that affect the company and it is more difficult to handle them.

You can find SWOT analysis template in documents to download on slide 12.

Target Market- We make the marketing plan for the market so describing your target market in this section is quite common. (This was answered in part 3.1. Target audience).

Analyze competitors – this was also included in chapter 3.3. You can add very slightly some information if you find it necessary.

Brand, Positioning & Message house– These topics were discussed shortly hereinbefore. In this section I would recommend only to simply describe the main vision and mission of the brand and its image.

Positioning should be clearly defined and chosen according to point of difference. As mentioned hereinbefore, positioning should contain 2-3 main points the company supports.

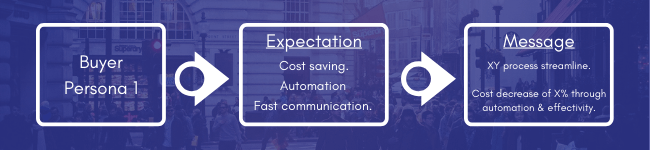

Message house is about the message delivery to each buyer persona. Each message is different according to buyer persona profile – target audience.

Marketing strategy & Tactics – Definition of the marketing strategy and channel distribution for the buyer personas.

For the marketing tactics you should understand and have a good plan how to distribute the message through the channels during the year.

You can find marketing tactics template in files to download on slide 14.

Goals setting & KPIs – Setting the right goal for your marketing plan is a difficult part as it may seem easy. To describe the goal to everyone is very clear.

You simply answer two questions in your mind: What objectives do you want to accomplish? Are there specific targets you want to hit?

Are your goals realistic and achievable? Each goal should have KPI to measure it as you can see the progress.

Do not set too many goals as it can be difficult to accomplish them. I suggest 3 to 5 goals. For instance:

- Market share (% from market)

- Revenue

- EBITDA

- CAC – Customer Acquisition costs

- # of new customers

- Customer excellence

Set a budget- Do you know how much funds do you require for a marketing activities? How much do you plan to spend on marketing and promotion throughout the next year, and how much will the action items you listed above cost you?

I strongly recommend to define each activity by % of the budget and then by absolute values.

Please notice that this budget is only for marketing activities. The whole budget for the company is covered in section 6 financials.

It is important that all expenses must fit financial projections.

4.3. Intellectual Property Rights (IPR)

What is Intellectual Property Rights?

Simply said it is all spiritual property (Intellectual). In this property are included all patents, licenses, know-how, brands and other objects of intellectual creation. IPR definition here.

This section is very important when making a business plan. Investors/ readers are interested in something unique and IPR gives answer to that question, on top of that IPR shows that you secured your secrets.

Describe the patents and copyrights that your company owns and explain how these may give you a competitive advantage or a superior position in the industry.

If your business depends on important licenses granted by others, give a short description of these licenses and indicate who provides them.

Explain how crucial they are for your production and how you have secured their use on acceptable terms in the future. Investors or lenders may be interested to know what would happen to your business if your licensor went bankrupt.

This point of IPR is important for your investors, banks or other contributors within your business idea. The reason is quite simple, a company with own know-how or patent that nobody is possessing is attractive for further development or investment.

Once creating IPR chapter please focus on following parts:

- IPR strategy and management

- IPR ownerships (list of your IPR – patents, licenses, codes etc…)

- Security before exploitation

- Knowledge management strategy

Before creating IPR chapter you should know answers to these questions:

- Do you or your company have/ has any intellectual property (IP)?

- What are your IPR assets? (Patents, copyrights, trade marks or know-how).

- Do you have any process or strategy for knowledge management to keep it sustainable throughout the company?

- Do you have any security to protect your IP against commercial exploitation?

5. Company Personnel Overview

In planning your business you have most probably thought about how you would like to structure the company, i.e. divide it into distinct functional units. You probably have also identified the head of each of these units.

If this work has been done, you should compile an organizational chart and include it in your business plan.

Providing the Company overview helps investors and lenders in many ways such as:

- Providing evidence to the lender or investor that you have seriously considered the future of your business.

- Confirming that you have identified the people required for operating the business. Naming persons in the chart helps to give a sense of reality to your business plan.

- Making clear to everybody in or outside the company who is responsible for what.

5.1. Team Overview

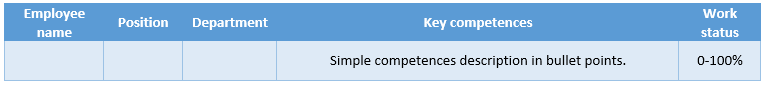

In this portion of the business plan we describe our company team. The main purpose of the team overview is team skills and capacities demonstration. You do not have to describe each member but only the leaders and key persons/ employees.

Investors/ partners need to see that responsible C+ level persons have appropriate experience to succeed with the project.

Here are few key points for team description:

- First/ Last Name

- Position

- Years of work experience

- Achievements in his/ her professional life

- Relevant bio (Why is he/ she crucial for your business)

- Unique skillset

After the key team member description you can also describe very shortly the team as a whole. You can highlight strong and weak points.

For the weak points try to turn your weaknesses into reasons what you will do next to cover these weaknesses. You can include also very brief description of team incentives.

In case of missing some key competences I suggest to insert short strategy how to secure these competences in future.

Internal solutions

- Know-how transfer: Trainings and education for internal employee. Newcomers in team with seniors.

- Succession planning: Key position and employees identification. Afterwards these employees are in the mamagerial programs.

- Key roles identification

- Identification of necessary skillset

- Staff capacity envisaged

- Training process

External solutions

- Standard search for employees

- Job portals

- Networking and contacts within the industry

- Personnel agencies and ATS

6. Financial and Project Plan

Financial planning is the key element for your business plan. It’s important not only for you as well as your investors, funds or the lenders.

For the company point of view all the decisions and assumptions that you make is totally depends on the finance because if you introduce new products, change the focus to new markets, refurbish your machinery, change your human resource policies, change the advertisement mix, etc., each one of these actions will eventually have an impact on your financial statements.

At the point of the investors, Your lender or investor will particularly want to know what you will be doing with the money you get and how you plan to generate the necessary cash flow to pay it back. A decision on whether your business will be funded or not.

6.1. Business Model

In this segment we cover all activity which generate revenue from operation. It is the DNA of the company’s strategy and it sets the direction for success. Here are the list of components that are found in most business models:

Unique Value Proposition:- UVP refers to explain why the customers are willing to buy our solution for there pain point to find out the answer are as follow:

- Identify all the benefits your product offers.

- Describe what makes these benefits valuable.

- Identify your customer’s main problem.

- Connect this value to your buyer’s problem.

Please note the difference between unique value/ selling proposition and point of difference.

UVP/ USP: Point out on the benefit that client will get from the usage of the product. Value for money.

Point of Difference (PoD) : This is the factor that makes product/ service standing out of the crowd. What makes it unique among the competitors.

Revenue Stream:A Revenue Stream is the building block presenting the cash a company generates from each Customer Segment.

Most businesses need at least one great revenue stream to earn money. I assume to find more revenue streams for your product. Let’s say main revenue stream and other complementary streams.

(For instance SaaS service can have main/ primary revenue stream from recurring payments, secondary stream from initiation fees, tertiary stream from add-on recurrent fees and quaternary revenue from customization).

If the investors bankers are investing money in their project they are very interested in from where you generate the profit or the revenue.

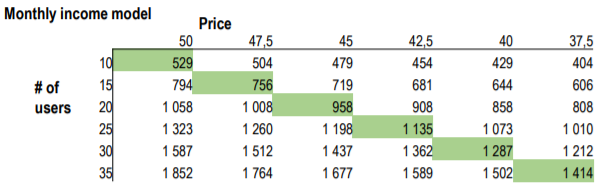

Pricing: Price refers to the product or service is based on supply and demand. This is very crucial part of your business model.

You must to choose pricing that generates enough money for you but it is not very expensive in the eyes of the customer.

How to setup the pricing properly?

I strongly recommend to choose several pricing options (not too many, best 2 – 4 as more options can be too confusing). Pricing depends also on quantity or usage frequency.

Use historical data and make assumptions to set the pricing policy properly and correctly. Best methods to set up pricing according to assumptions are sensitivity analysis (in excel what-if scenario) or simple stress test made of three options (# of users, type of the user or whatever your client segment is).

In sensitivity analysis you usually change 2 variables and you see the possible or best fit options to choose from. Afterwards you can create packages the client can choose from. (For the investor information it is satisfactory).

6.2. Financial Statements

Financial statements are written records that convey the business activities and the financial performance of a company. You share your detailed financial statements with your investors or lenders in later negotiations about the investments or financing:

- Balance sheet

- Income statement

- Cash Flow statement

You can find templates for financial statements in files to download 15,16 and 17.

At the beginning of the it is enough to have an overview of your financial statements.

6.3. Forecast and Break Even Point (BEP)

6.3.1. Forecasting Revenue

Your business revenue forecast is an essential part of future business planning. In this we calculate approx. how much revenue we earn in future it doesn’t show the exact figure of the future revenue but it does provide several methods that will help you forecast your revenue as accurately as possible.

Forecast can be very detailed and you can take many approaches how to forecast. For the needs of a standard business plan I would suggest simple forecast.

You can find forecasting model in files to download sheet PnL_FC.

It does not matter what kind of a forecast do you provide. What matters most to investors or funds are these 3 main parts: Assumptions [your data baseline], breakdown of the income or expenses, company historical data (financial one).

Few best practices in forecasting:

- Make 2 or 3 versions of your forecast. It is also called realistic, pessimistic and optimistic forecast.

Make breakdown of your revenue (show in which streams all revenue will be composed). Do not forget to include changed expenses for each scenario. - Check your assumptions twice. OR you can simply buy a study from given industry to make a benchmark for your data. (This part is very important for the investor as the assumptions and its granularity gives high credibility to your forecasts).

- User historical data. You can include (recommended) your last 3 years data to better forecast your business.

- Forecast up to 3-5 years. No more. As forecast for 6-10 years is much more a prophecy of an oracle than valuable forecast.

6.3.2. Break even or Break even point (BEP)

Break point refers to the point where our total cost is equal to total revenue (TR=TC). It is a situation where a company has neither loss nor profit. We include this point in this business plan because investors are concerned about that point the reason behind it when the company crosses the break point after this company starts earning profits.

Break even is included in business plan usually if you start to run the business. In case of a company with longer history you do not have to include break even (Income statement forecast shows the investor when he will get his return on investment).

Once again as for the income statement or revenue projection you can calculate BEP by single way or more exact but difficult way.

You can find break even template in files to download on sheet PnL_FC.

A. Single way calculation of break even point (BEP)

- BEP calculation based on units: BEP(units) = Fixed costs / (Revenue per unit – Variable costs)

- BEP based on sales: Divide the fixed costs by contribution margin. BEP (sales) = Fixed costs / contribution margin.

Contribution margin = Price of product – Variable costs

This single ways shows simply to investor when business starts to earn money .

B. More sophisticated BEP calculation

EBITDA + Income tax + Change in working capital + CAPEX = Free cash flow to firm (FCFF)

FCFF + Interest costs + Repayment (Principal) = Free cash flow to equity (FCEE) In the moment (in the year) when FCEE in excel is 0 or higher, that is the year of BEP. Year when the investor starts earning money and his investment will be repaid. (Said very simply).

Note: If you are not very experienced in financial calculations I would strongly recommend to ask a financial controller, advisor or accountant for help with breakeven or all financial calculations as they are very important for investor decision making.

6.4. Development Timeline, Milestones and Work-packages

6.4.1. Development timeline

A development timeline serves as the initial schedule that an entity will follow in developing its products, systems, or processes. Development timeline assure that the expected or target completion date will be achieved. with regarding

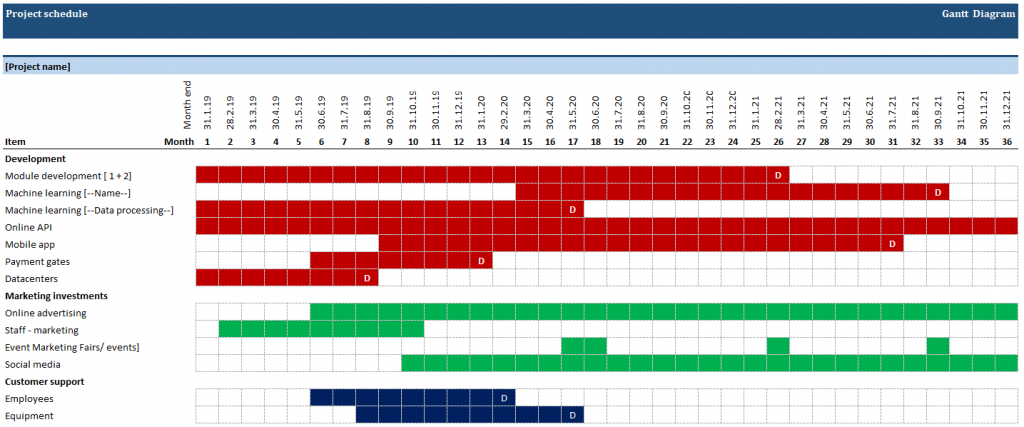

I recommend to use Gantt chart in this section. (We mentioned simple timeline in previous chapter 2.1. ).

You can find Gantt chart template in files to download on sheet Gantt.

6.4.2. Milestones

Milestone is the list of what is supposed to happen in the organization. In the list we include when it starts, when it finished, what’s the budget, who’s in charge, and which department is responsible for the activity.

Milestone table is very important table in a business plan, because it’s so obviously important for tracking progress and making your planning part of your management Example of milestone table you can make this table in Microsoft Excel, Apple iWork, Lotus 1-2-3, and of course, Business Plan Pro or other simple software.

Few important parts that a milestone should incorporate:

- Name of the milestone/ activity

- Starting and ending date of the activity

- Responsible person for the activity

- Department

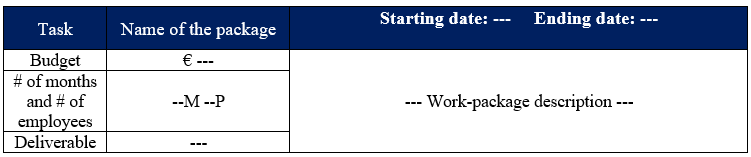

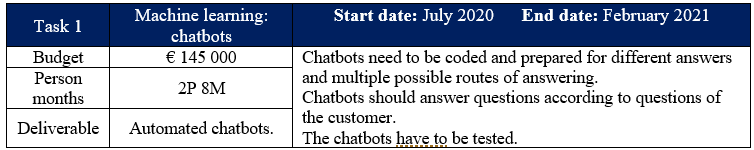

6.4.3. Work packages

Work-packages refers to breaking the project and milestones into small tasks (modules) which shows activities related to the product/ service creation.

For each activity or milestone in the work-package set the following:

- Number of the task

- Name of the work-package

- Start & end date

- Number of persons working on the work-package and number of the months the works will take

- Requested budget for the work-package

- Description of the work-package

- Deliverable

6.5. Risks and Opportunities

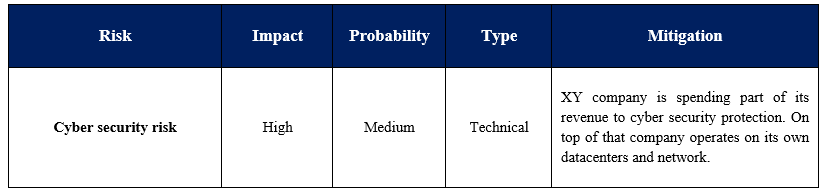

6.5.1. Risks

Business plans are based on numbers of assumptions. All the assumption that we made is not true all the time actual results are totally different from the assumptions that we make so all the investors which are invested in our project they are likely to know “What will happen if one or more of the parameters deviate significantly from your original estimates?

How will your financial situation be affected? What is the risk that your cash flow, profitability and balance sheet will deteriorate so much that your whole firm is seriously endangered?”

Briefly you should show to investor that you accounted for certain risks and you know how to lower/ mitigate them once they occur.

In your risk table you should include following.

- Risk name

- Impact (Low, Medium or High)

- Probability (Low, Medium or High)

- Type of the risk (Exchange rate, technical, commercial etc.)

- Mitigation – here you describe how to lower the impact of the risk or how to avoid it.

6.5.2. Opportunities

In your possibility plan you should not only consider possible deviations from your assumptions that would mean extra risks for your business. You should also think about how you would deal with the challenge if the business developed much better than you assumed. Here are the example:

Your sales volume rises much more rapidly than you assumed. How can you increase your production capacity in the short term? How do you quickly find additional suitable employees? Can you outsource some of the work?

Your cash flow increases more than expected. What do you do with your extra cash? Can you negotiate with your bank and repay your long-term debts earlier? What is the optimum way to invest the money: expand the business of the company, acquire another firm, buy securities, etc.?

Your major competitor sells his business. An important competitor decides to sell his business at a good price, for example because there is no successor to the owner, who is retiring. What would you do? Buy the whole company and integrate it into yours? Buy only the assets? Buy only the clients?

Table of opportunities has similar points as a risk table. (Opportunity, impact, probability, type and description).

6.5.3. KPIs

It is necessary to include KPIs into the business plan as the investor or whoever could see how and what are you going to measure.

High-level KPIs may focus on the overall performance of the business, while low-level KPIs may focus on processes in departments such as sales, marketing, HR, support and others. KPIs were mentioned in the chapter 4.2.

In this only worth to mention KPIs general groups.

High-level KPIs

Revenue, EBITDA, market share, annual growth or other similar.

Low-level KPIs

We can divide them into categories like financial KPIs, commercial KPIs (market share, revenue, expenses marketing and sales, customer acquisition costs, monthly recurring revenues etc.), technical KPIs (to achieve certain technology level) and others.

7. Appendix

Explanation of how to use the appendix

Appendix in business plan we should write most notable achievements of your management team in this section of your business plan. Then, at some point early in this section, you can place a parenthetical reference to the inclusion of their resumes.

The reader can decide for himself whether to read or not. Content should always be your guide, just as surely as you should include copies rather than original documents in the appendix. Consider your options, which depend on the content in your business plan:

- Building permits.

- Charts and graphs.

- Competitor information.

- Credit reports.

- Equipment documentation.

- Incorporation papers.

- Leases or rental agreements.

- Legal documents.

- Letters of recommendation.

- Licenses, permits, trademarks and patents.

- List of business affiliates, such as your accountant and attorney.

- Marketing reports and studies.

- Pending contracts.

- Pictures or illustrations of your product line.

- Press clippings, feature articles and other media coverage.

- Resumes.

- Spreadsheets.

- Tax returns

Conclusion

If you made it to this end, “Congratulations” ?? you are one step closer to make an outstanding business plan for your target audience. Next step is just the practice.

In the nutshell, strategic business plan is a summary of the whole business in one document. The reader must get good and granular grasp of what is going on, when, how and why.

The business plan informs and plans next steps in business, on the other hand it ingorms key stakeholders such as investors, banks, funds, strategic partners, owners or key employees about the next steps of the business.

Each chapter of the business plan should support other and everything must be aligned – financially and strategically as the reader can see trustworthiness of your plan.

Do not forget when writing a business plan most important chapters such as executive summary, problem and solution, innovative idea, point of difference, growth strategy – go to market strategy and financials.

Now it’s your TURN. What interested you the most or what are your business plans to be prepared? In case of any questions or suggestions let me now in comment below or by the message right now.