Pitching and presenting to investors your idea or business is very difficult and problematic task to do. It is even more difficult when you are doing it for the first time and I will tell you that the presentation (pitch deck) and your investor speech have to be perfect.

Once the investment meeting has started this time you have only one shot to hit the target. I know this because I have done it many times.

Having a good pitch presentation will initiate the investment meeting where you tell more in detail about your project/ business.

With this being said the investor pitch is very crucial thing for the meeting initiation as the presentation is asked for before the meeting.

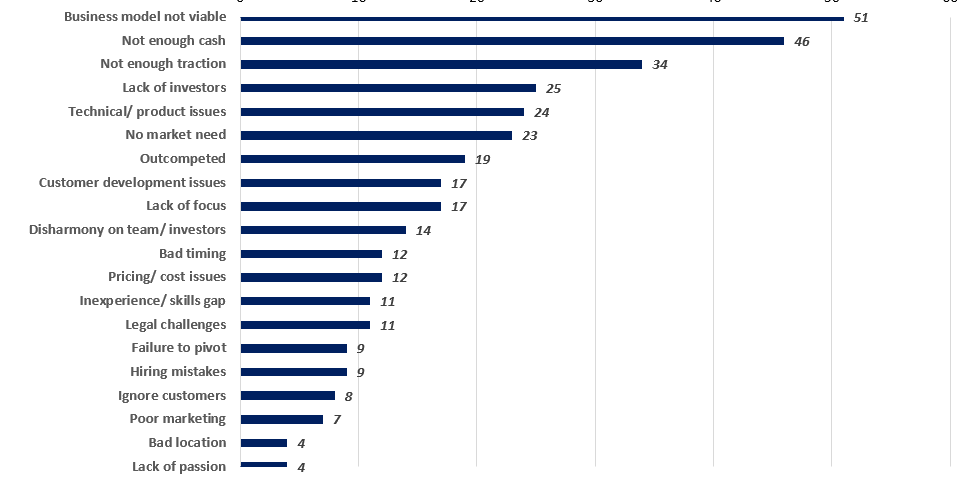

At the end of this article I give you one statistic about the fails of start-ups and believe me or not the lack of cash or insufficient investors is among top 5 reasons why the start-ups businesses fail.

The article should help you up in building a compelling pitch deck and support your project/ business in its success in front of investors.

What will you learn in this article?

- What is an investor pitch deck

- Rules to create a pitch deck

- Structure of a pitch deck

- Structure of a pitch deck

- Pitch deck examples

- Pitch deck templates

Files to download

1. What Is an Investor Pitch Deck

Pitch Deck is a presentation that an entrepreneur makes to show its business idea to potential investors to receive funding from them.

Business pitching objective is to provide a complete overview of your business strategy and products/services, convey why it is a good investment, and build enough faith in it that they become willing to invest.

One of the most prominent reasons for a start-up failing is having not enough funds to keep it afloat.

Without proper funding, your business would likely not make it past its infancy. Getting these early investments can be the difference between success and failure. But investing in a fresh start-up would seem risky to anyone even more risky without any previous track record or history.

How can the investor trust your product/business to be successful in the long run? Every start-up believes that their product is the next big thing and a good startup deck should convey those feelings to the investors.

They hear a hundred startup pitches every week if not in a single day and it is the job of your pitch deck to capture their attention long enough for you to present your idea and product as something worth putting money in.

2. Rules to Make a Pitch Deck

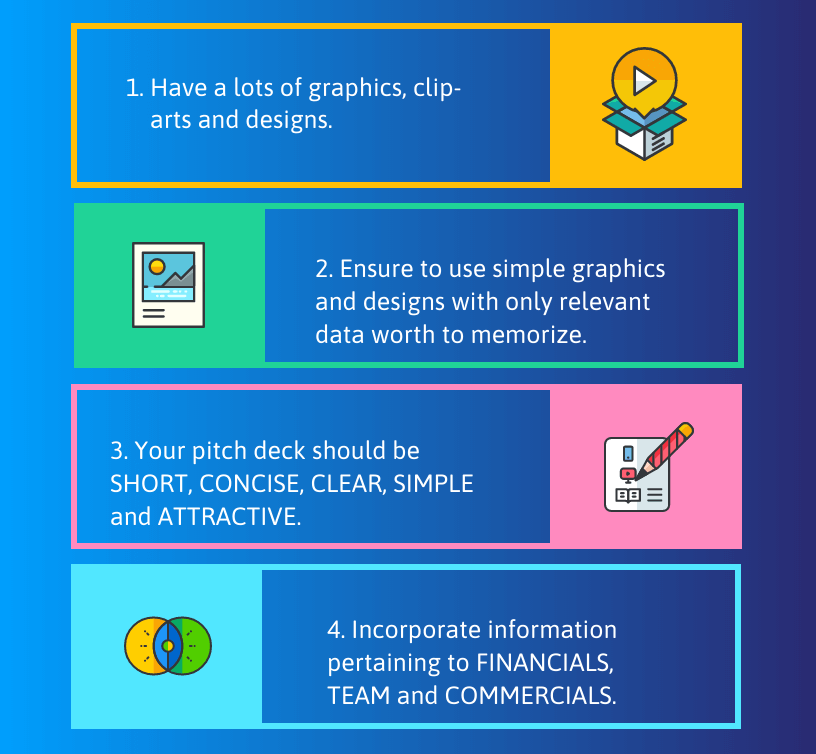

Important aspects to incorporate into pitch deck presentation

In essence, your pitch deck should include all the information one might need to know all about it at a glance. Having lots of graphics, clip-arts and designs help more than having a lot of text or numbers on the screen.

There would be no point to you standing and ‘presenting’ if you put all the information on the screen itself. The pitch deck is there to facilitate and enhance your ‘pitch’.

Please keep in mind that investors have a huge amount of information passing through their heads every day, they are overwhelmed with numbers and fact. Therefore, I strongly recommend to use simple graphics and designs with only most relevant data worth to memorize.

Length of the presentation

Investor pitch should have 15-19 slides at max. It should be short, concise, clear and simple, easy to understand, and most importantly attractive enough to keep the investors’ attention.

It should be elaborated enough to build trust in your business but short and simple enough to not bore them to sleep.

What are investors looking for

According to research done by DocSend, investors spend on average 3 minutes and 44 seconds per pitch deck.

From their study which analyzed 200 pitch decks, investors spent the most amount of time reviewing the slides concerning financials, team, and competition.

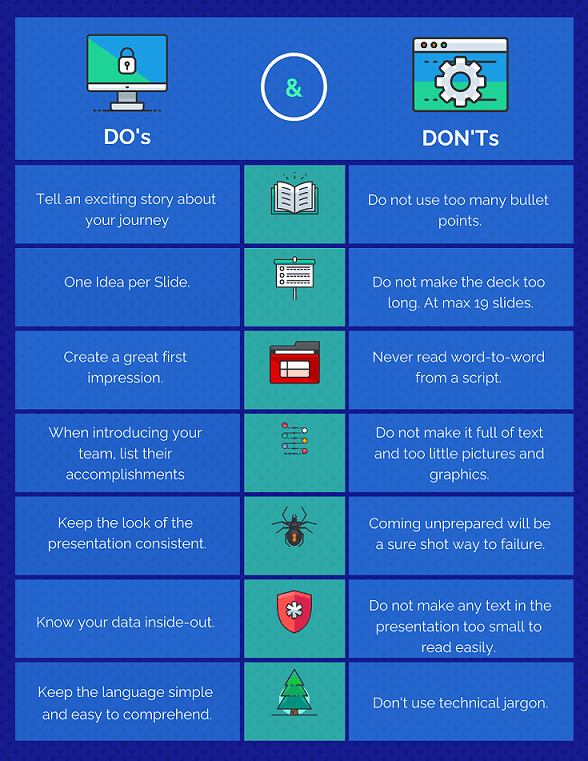

Do and Don’ts when creating the investor deck

3. Structure of the Pitch Deck Presentation

Cover Slide

The first should usually include a high-resolution photo that represents what your company does. It could be your product/services in action or a simple picture related to the industry you are in.

Adding a few celebrity testimonials and endorsements will only work in your favour. It would help develop trust and provide a positive first impression.

Intro

This slide should not contain a lot of text but act as a backdrop, for you to speak and give an overview and tell your story. Talk about the industry you operate in and how you got into the industry.

Problem

This is the slide where you present your audience with a problem that is currently going unattended. A problem that if solved, can generate a lot of money for those solving the problem. It is best to focus on a single problem and not overwhelming your audience.

You need to explain this problem in such a way that it becomes relatable to your audience and they should feel that they have also experienced this in their life, provide a clear sense of return-on-investment once it is solved, and it should be explained in terms that are easy to understand not requiring a lot of expertise in the subject.

All this should be ‘explained’ instead of ‘typed in’ and the slide should have visuals that highlight the points you are speaking about and allow the audience to skim through them quickly.

Solution

This is the slide where you highlight the importance and need for your product in the market. With the problem already explained, all you have to do is show how your product is solving that problem.

This should be explained in short-concise terms and should also explain how scalable the solution is, ie how much the venture will grow upon receiving additional funds. Investors like to see that investing and helping a business grow will multiply their investments and make them even more money. That is why it is best to show that this is a global solution and has potential for the worldwide market.

You should also mention how this is the right time to go into solving this problem and how delaying it will hurt the returns on investment. Creating a sense of urgency would urge your audience to know more about your solution and keep their interest.

Describe Market and Its Opportunity

This slide should provide your audience with graphs on market trends for the past years and projections on the potential growth once your solution is applied.

Providing relevant sources from research papers for the visuals you are showing is also a good idea.

Investors are looking for companies to invest in that would result in 5-10x growth and returns on investment in the next 5-7 years. Providing them with reliable data as proof of this will get you an investment quickly.

Please include important metrics such as CAGR and market size in absolute numbers.

Tell a Story

Tell a short story and include key members of the company into it. (Founder, Co-Founder).

This is the slide of the pitch deck where you introduce your team and your company. The investors need to know ‘who’ they are putting their money behind and what makes them so unique than hundreds of others who are also asking them for their money.

All people love stories even investors. Strong and comprehensive story can grab investor’s attention and that is what exactly you want.

The best way to showcase your team is by listing the key leadership personnel (founder/co-founders), list their main achievements, skills, background, and their specific role in the company.

Investors like team members with diverse skillsets and experience. It usually makes the team better at dealing with the various roadblocks they will face.

On top of that please focus mainly on roles such as finance (CFO), marketing (CMO), business development and if necessary (for products) technical department (CTO, CIO).

These key positions and departments are crucial in order to achieve the success with the project.

I recommend to describe the story of the product/ service with its founders behind with short timeline of the development history until presence.

Company Vision

It is important to any project to have a vision. Investors like to know that the company is in for the long run whether it is prepared to go the distance.

You can convey that in this slide by declaring what your vision in and where you want to take your company. It is best to set a tentative target for the near future and highlight it on the slide. Make sure to make it achievable and not something outlandish and impractical.

Here are some examples of company visions:

AirBnB vision “Belong anywhere.”

Amazon vision “Come build the future with us.”

Apple vision “Bringing the best personal computing experience to students, educators, creative professionals and consumers around the world through our innovative hardware, software and internet offerings.”

Solar System Scope vision “Providing user space intense experience with usage of modern technology.”

Short Product Description (How It Works)

Your product should be the star of the show and should be presented with the same emotional energy that you have had while developing it.

This slide should have screenshots of your product in action and should explain how it works. When presenting I recommend to use a short demo video to demonstrate your product.

You can add a link to the product website and add short videos on the product’s key features.

Adding testimonials and reviews here saying how great your product is will go a long way.

Some References (if any)

You can add the testimonials and references mentioned in the previous point in a separate slide and provide additional information about the current traction you have in the market and the figures and metrics regarding your client base and how much business you have already done.

If your start-up is in a very early stage and your traction is not that impressive, it would be best to skip this. People invest to help companies and products grow and increase their market share, not to start companies and create products.

Competitive Landscape

Unless you are pioneering an entirely new field, you will be having pre-existing competition in your field. This slide should be used to indicate how your company compare to them and how you will fare with your valued proposition.

You need to present how your company brings something unique to the market that others do not have.

Otherwise, the investor might just dump you and go for those companies instead. You could also include statistics regarding the investments your competition has gained and what their valuation is to help provide your investors with an idea of how profitable the market is and give you some ground to negotiate on once a potential investment or terms of a deal are discussed.

Competitive Advantage and Uniqueness

This slide or slides show to investors why to invest in your company. Why the product is worth of investment. Bear in mind that this slide can be decision point for your financing.

Please see the difference between competitive advantage and uniqueness.

Competitive advantage perceived from the company’s point of view. This advantage includes resources or capacities of product advancement.

For instance, resources can be lower production costs compared to competition. For the capacities it is the unique know-how, specialists in the team, network of resellers or specific brand.

Uniqueness is quite different than competitive advantage. We can translate it as a reason to buy. Here you are differentiating your product from the competitive ones.

Uniqueness in the eyes of the customer therefore why the customer should buy your product.

For example, high level of innovation, superior customer support, user experience or lowest price on market.

Customer Description

You can add a separate slide to discuss the demographics you are targeting and the kind of customer your product will be marketed towards. This may give the investors an idea of how much scope there is to grow and expand.

You can find more detailed customer description in my previous article of business plan.

Business Model and Financial Forecast

Revenue generation model

You need to provide a functional model on how you aim to get revenue and projections on how much you hope to increase it post getting the funding. This needs to be a realistic and practical model. A good way to go about it is to be modest at this stage and outperform in practice.

Financial forecast

You can provide graphs on your current financials and projections on where you hope to reach in a specified amount of time. This is usually the next 3-5 years.

How to create a financial model

It is best to have a financial model made in Excel for your investors to go through after the pitch presentation if they are interested. A financial model is simply a tool that’s built-in Excel to forecast a business’ financial performance into the future.

The forecast is typically based on the company’s historical performance, assumptions about the future, and requires preparing an income statement, balance sheet, cash flow statement, and supporting schedules.

You can find some help with financial model in our Business plan article part 2.

What are the costs to consider

You need to provide your investors with proper figures regarding all the costs your company is currently incurring and all the projected costs that will be incurred upon scaling. These include production costs, salaries, marketing, and all the other management costs that are needed to keep the company afloat.

Market Expansion & Market Overview

As mentioned before, investors love scalable ideas. You need to have plans ready to scale to higher markets if asked for them by the investors. Doing that will only make your product more palatable for them and they will be more willing to invest. Even if you are freshly starting, it is still better to have a long term expansion plan in place.

Be granular about your scalability as this is the one of the main criteria in investment decision.

You can find some help about the scalability and business model in our business plan article part1 and part 2.

Marketing Strategy (Facultative)

You also need to have some plan for the marketing of your product. This could include any online or offline marketing activities such as fairs, events, website and blogs you are running for the product.

Any social media marketing campaigns that you have started to promote your product and brand. I recommend to put everything at one slide. You can simply describe your marketing activities in one slide.

Please see example here. It is useful to mention any metrics or KPIs you are after.

Investment Need and Proposal

It is better not to be specific and direct on your ‘ask slide’. Providing a range instead of a single figure is best.

Instead of asking for 10lacs, you should provide a range of 8-12lacs. This way if an investment firm that does not give out investments over 8lacs can also be pitched the same as ones that do not have any such mandates.

You need to clearly justify why you need the amount you are asking and how it will help your progress. This proposal needs to be described in such a way that it provides a good sense of the ROI to the investors.

How are you going to spend the investment

A slide to show how the investment will be utilised would build trust and confidence in your company.

Contact Information

At the end of the presentation include the contact information for key person responsible for the investments.

Appendix

An appendix should be used to provide all the additional data about the company, product, contact details, legal information, statistics, and projections that could not be included in the verbal pitch for review by the investors later. This is facultative option and it is often included in business plan.

4. Reasons Why Investments Fail

There are many reasons why business idea/ startups fail. Getting investment in the company is the difference between the success and failure of the project.

It is very important to convince the investor to enter/ invest your business, thus the investor pitch is the critical point where to make an impression and start negotiations about your financing.

You can find sorted company reasons of failure in their business. In top 3 reasons we can see viability of a business model, cash or investor issues and traction to business or customers.

5. Pitch Deck Examples

6. Pitch Deck Templates

Conclusion

Starting or running a business is not a simple task. Getting enough cash, financing and support to scale it wider and faster is even more difficult than before. There are HR, competition, legal, country or cultural issues that can hinder your business.

Running your business worldwide or on higher scale is becoming a viable task for any serious entrepreneur. For this reason you have to find and convince an investor that your idea will shine in business sky and for this purpose you need a persuasive investor pitch deck ready with a quality business plan.

Briefly the investor pitch presentation has a simple task to grab attention of the investor. You presentation should be short and factual. By short I mean up to 10-15 minutes with length of 10-20 simple slides on average.

Creating a solid pitch deck can be a little bit tricky but keep in mind the rules mentioned in this article and you will get exactly where you want.

Remember to engage your audience and tell the story about your business idea. Thus, do not forget to include crucial parts into your pitch deck.

The problem and solution you are providing to your customers, team description with its key competences, clear vision, product description that simply define your product/ service (best with demo – video or real time presentation).

Next describe the competition and market opportunity, showing your competitive advantage and unique selling proposition is the key element in investor decision making hand in hand with smart business model and investment appetite.

Please take into account following aspects during the investment decision making. Be in shoes of the investor and save him time by giving only relevant and necessary information. Do not overload him with data at the beginning.

Keep in mind that more simple it is to understand the higher chance to get the investment. Investors do not like to enter investments they do not understand in first minutes of the presentation.

And last but not least, if the investor will not decide to continue with your case it is absolutely normal as there can be many reasons why he did it. (Different area of investor interest, more other projects to invest, economic and financial situation of the investor – deciding to split his/ her money into more projects, personal attachment etc.)

With this being said I recommend to keep going and ticket more investors at once with your pitch deck, as you can also choose the investor that best fit for your project as mutual cohesion is very important after a collaboration decision.

Being prepared and having a plan shows that you are very serios about the project.

Finally I wish you a lot of success with your pitch presentation and during investment negotiations.

Now it’s your turn to ask if you want to know more about creating the investor pitch deck or simply comment below what interests you the most or just write me your questions.